There are thousands of public companies in the United States. Thousands more are listed in other countries like Canada, Australia, and Germany.

With so much happening every day, it is not humanly possible to follow the details of these firms. Therefore, having a stock watchlist can help you simplify your trading and identify opportunities.

WHAT IS A TRADING STOCK WATCHLIST?

As the name suggests, a watchlist is a compilation of stocks that you are paying attention to in the market. The goal of this watchlist is to simplify your trading and making you spot opportunities as soon as they arise.

Fortunately, many website and mobile applications give you a free platform that helps you create watchlists. Some of the most popular platforms that offer these watchlists are MarketWatch, Yahoo Finance, and Webull.

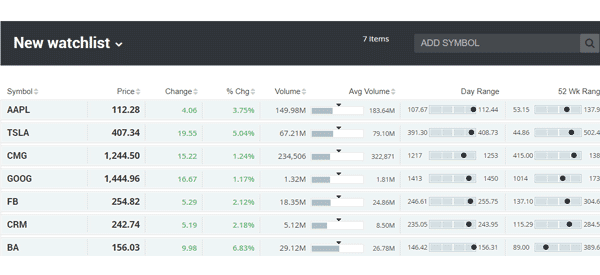

Also, many online brokers offer these watchlists. The chart below shows you an example of a watchlist from Marketwatch.

As you can see, this watchlist contains the company’s symbol, the current share price, the percentage change, the daily range, the 52-week range, and the volume. Therefore, if you are trading, having such a watchlist will give you so much details even before you initiate a trade.

For example, when you look at Boeing (BA), you see that the stock has jumped by almost 7% while the volume is along the daily average. This can tell you whether the rally is sustainable or not. It could also push you to do more research on the catalysts that pushed Boeing that high.

There are other watchlists that are provided by some online companies. These firms will send you a watchlist summarising all events that are moving the market before the trading sessions start.

Our partners (TraderTv) offer a very interesting one, sent twice a daily.

WHY BUILD A DAY TRADING WATCHLIST

Most successful day traders, especially those who focus on stocks, always use a watchlist for several reasons such as:

- Simplifying their trading – With a watchlist, they are able to keep their trading simple than when they are tracking everything.

- Identifying opportunities – With this tool, traders are able to easily identify trading opportunities.

- Easy to use – A trading watchlist is usually relatively easy to use since it scans the entire market for them.

- Seeing what is relevant – Traders build a watchlist because they want to see what is really relevant to them, removing as much noise as possible.

TYPES OF MARKET WATCHLISTS

There are several types of watchlists you can create in the financial market. Some of these lists are:

- Watchlists based on assets – You can create a watchlist based on the specific assets that you trade. For example, if you are a cryptocurrency trader, you can create one list to that tracks the digital currencies that you trade. Similarly, you can create it for stocks, commodities, and ETFs.

- Based on industry – If you are a stock trader, you can create a watchlist based on the industry that you follow. These could be finance, retail, consumer, and technology.

- Based on size of companies – You can create a stock list based on the size of companies that you trade. For example, this can include penny stocks, large-cap stocks, and mid-cap stocks.

HOW TO CREATE AN EFFECTIVE STOCK WATCHLIST

The process of creating a trading watchlist is relatively easy, now that we have many free platforms that you can use. Some of the key steps you should follow are:

- Understand the type of trader that you are – There are several types of traders. For example, there are scalpers, swing traders, and algorithmic traders. Each of these traders will require different types of watchlists.

For example, a swing trader will want to see the technical arrangements while a long-term trader will want to see more fundamentals. - Select a watchlist platform – Next, you need to select a platform that provides a good tool for creating your own list. You can try our TraderTV platform.

- Refine your list – Finally, you can refine your list by adding some of the items that you follow. These could be from a fundamental and a technical side.

FINAL THOUGHTS

A day trading stock watchlist is an excellent trading tool that can help you simplify your daily practice. It condenses what is going on in the stock market to a small and easy-to-see dashboard. It is also an excellent tool you can use to identify new trends and also minimise risk.